By Daily Finance 360

In today’s data-driven economy, a credit score is more than just a number — it’s a critical factor that shapes access to financial opportunities. Whether you’re applying for a mortgage, financing a car, or even renting an apartment, your credit score plays a central role in how financial institutions assess your reliability. As financial technologies evolve, so do the mechanisms behind credit scoring. In 2025, understanding how these scores are calculated and how to manage them has become more important than ever.

What Is a Credit Score?

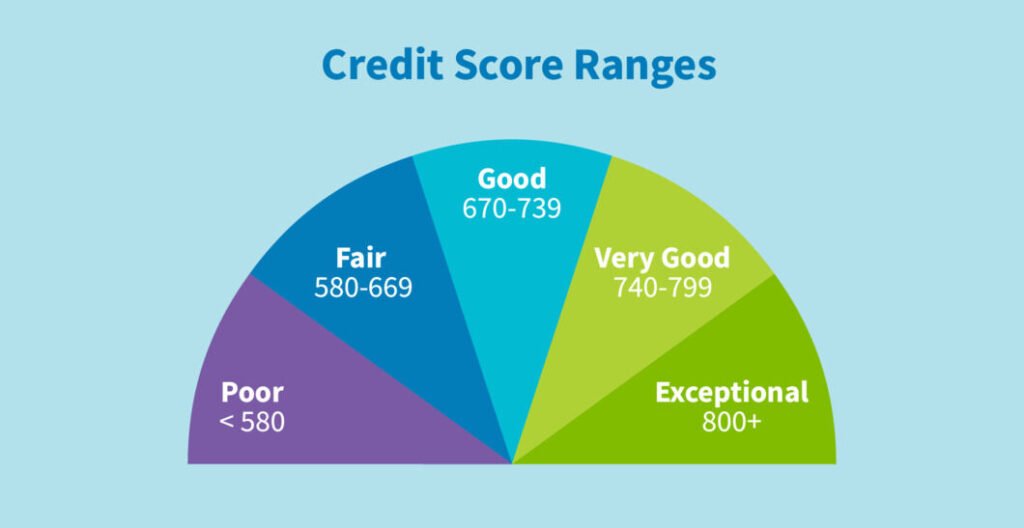

A credit score is a numerical representation of an individual’s creditworthiness. The most commonly used scoring models, such as FICO and VantageScore, range from 300 to 850. Generally, a score above 700 is considered good, while a score below 600 may limit access to credit or result in higher interest rates.

How Credit Scores Are Calculated

While different scoring models may use slightly varied criteria, the core components typically include:

- Payment History (35%): Timely payments are the most significant factor.

- Credit Utilization (30%): The ratio of credit used to total available credit.

- Length of Credit History (15%): Older accounts can positively influence scores.

- New Credit Inquiries (10%): Frequent applications can temporarily reduce scores.

- Credit Mix (10%): A balance of credit cards, loans, and mortgages may help.

2025 Trends: What’s Changing in Credit Reporting?

In recent years, credit bureaus have begun integrating alternative data to provide a more holistic view of consumer behavior. This includes rent payments, utility bills, and even subscription services. Additionally, artificial intelligence is being deployed to enhance risk modeling and detect fraudulent activity with greater precision.

Some lenders now offer tools that allow borrowers to simulate how financial decisions—like paying off a credit card or taking out a loan—could affect their credit scores. This shift toward transparency is empowering consumers to take more informed actions.

Why Credit Scores Matter

A strong credit score can unlock lower interest rates, higher credit limits, and more favorable loan terms. Conversely, a poor score may result in financial setbacks and restricted access to essential services. Employers and insurance companies also increasingly factor credit scores into their risk assessments.

Best Practices to Build and Maintain a Strong Credit Score

- Pay All Bills on Time: Missed payments can have a long-lasting impact.

- Keep Credit Utilization Low: Aim to use less than 30% of available credit.

- Avoid Opening Too Many Accounts: Each application generates a hard inquiry.

- Check Credit Reports Regularly: Look for errors or unauthorized activity.

- Maintain Long-Standing Accounts: Closing old credit lines can lower your average account age.

Final Thoughts

As credit scoring evolves in the digital age, staying informed and proactive is key. Understanding the components that shape your score—and how financial institutions interpret them—will help you build a stronger financial future. In a world where data determines access, your credit score is one of the most valuable financial assets you control.